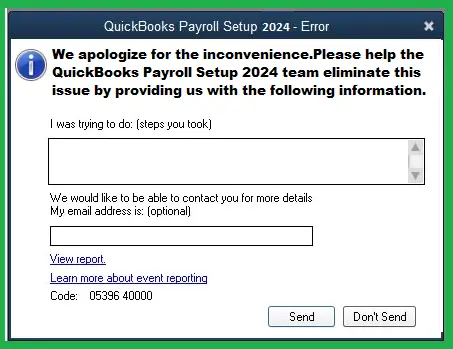

Encountering QuickBooks payroll setup errors, such as the troublesome “Error Code: 05396 40000,” can be a roadblock for businesses seeking seamless financial management. This article provides a detailed guide on resolving these errors, offering step-by-step solutions to tackle specific issues related to file names, duplicate employee records, and other potential obstacles.

Understanding QuickBooks Payroll Setup Error 05396 40000:

QuickBooks users facing the payroll setup error 05396 40000 may find their workflow disrupted. This error can manifest during various actions and across different QuickBooks versions. The ensuing frustration and potential workflow disruptions necessitate prompt resolution.

Step-by-Step Solutions for QuickBooks Payroll Setup Error 05396 40000:

Solution 1: Addressing Error Code 05396 40000

- View Report Link:

- Click on the ‘View Report Link’ option when the error message appears.

- Open the ‘ReportHeader.xml’ file in Internet Explorer to identify the error’s origin.

- Search for Exception String 0:

- Use ‘CTRL+F’ to search for ‘Exception String 0’ in the report.

- Make necessary adjustments based on the error details.

Relate Post: What is QuickBooks Error H202 (Multi-User Switching Issue)?

Solution 2: Rectify Specific Error Messages

- Error 1: Identify and resolve duplicate items in the payroll item list.

- Error 2: Delete duplicate employee names, transferring active payroll transactions if needed.

- Error 3: Review and correct name setups for employees, eliminating unnecessary spaces.

- Error 4: Resolve issues with the Invalid Storage Category Map for Local Tax Payroll Item.

- Error 5: Address ‘System.IO.FileNotFoundException’ by repairing or reinstalling QuickBooks.

- Error 6: Rectify ‘Value Outside Expected Range’ by configuring state information for employees.

Conclusion:

While these step-by-step solutions aim to resolve the QuickBooks Payroll Setup Error 05396 40000, some users may require additional assistance. In such cases, reaching out to certified ProAdvisors at QuickBooks Data Service (1-888-538-1314) ensures prompt and expert support.

Additional Tips:

- Regular Maintenance: Conduct routine checks for duplicate items and employee records to prevent future errors.

- Employee Information Configuration: Ensure all employee information, especially state-related details, is accurately configured.

- Timely Updates: Keep QuickBooks updated to access the latest features and bug fixes.

- Professional Assistance: For persistent issues or uncertainties, seeking professional assistance ensures a swift resolution.

Contact QuickBooks Data Service for Expert Assistance:

If the QuickBooks Payroll Setup Error Code 05396 40000 persists, don’t hesitate to contact QuickBooks Data Service at +1-(855)-955–1942. Their round-the-clock availability ensures users receive immediate solutions and expert technical support.

You May Check Related Artilce QuickBooks Payroll Not Working:

Keeping your payroll system up-to-date is crucial for ensuring accurate and timely payments to your employees. However, encountering issues with the payroll update process can be a frustrating experience. In this guide, we will explore common reasons why your payroll update might not be working and provide comprehensive solutions to address these issues.

- Check Internet Connection: One of the primary reasons for payroll update failure is a poor or unstable internet connection. Ensure that your internet connection is stable and has sufficient bandwidth to download the necessary updates. If possible, connect to a high-speed and reliable network to avoid interruptions during the update process.

- Verify Software Compatibility: Ensure that your payroll software is compatible with the operating system and other software components on your computer. Sometimes, updates may fail if there are conflicts between the payroll software and other applications. Check for any compatibility issues and update your software accordingly.

- Review System Requirements: Make sure your computer meets the minimum system requirements for the latest payroll update. Inadequate system resources, such as low disk space or outdated hardware, can hinder the update process. Upgrade your hardware if necessary and free up disk space to facilitate a smooth update.

- Update Antivirus and Firewall Settings: Antivirus programs and firewalls play a crucial role in protecting your system, but they can also interfere with the payroll update process. Temporarily disable your antivirus and firewall settings during the update, or configure them to allow the payroll software to access the necessary files and servers.

- Clear Cache and Temporary Files: Accumulated cache and temporary files can sometimes cause update failures. Clear the cache and temporary files on your computer before initiating the payroll update. This ensures a clean slate for the update process, reducing the likelihood of errors.

Also See: Possible Causes of QuickBooks Payroll Disappearance

- Backup Data Before Updating: Before proceeding with the payroll update, always create a backup of your payroll data. This precautionary measure ensures that even if the update fails, you can restore your system to its previous state without losing important information.

- Consult Vendor Support: If you continue to experience issues with the payroll update, reach out to your software vendor’s support team. Provide detailed information about the problem, including error messages and any troubleshooting steps you’ve taken. Vendor support can offer specific solutions tailored to your software and system configuration.

- Manually Download and Install Updates: In some cases, automated updates may fail due to network issues or other technical glitches. Check your payroll software provider’s website for manual update files. Download the latest update manually and install it on your system following the provided instructions.

- Perform Software Reinstallation: If all else fails, consider reinstalling the payroll software. Uninstall the existing software, download the latest version from the official website, and install it on your system. This process can resolve underlying issues and provide a clean slate for the payroll update.

Final Thoughts:

Mastering QuickBooks payroll setup involves addressing specific errors systematically. By following these detailed solutions, users can navigate through challenges and ensure a smooth financial management experience. Remember, timely resolution and proactive measures contribute to a robust QuickBooks payroll system, allowing businesses to focus on growth without interruptions.(realgadgetfreak)

Blogging World Tech

Blogging World Tech